UOB FinLab Vietnam: Digital Gateway to Global Markets — Event Recap

UOB FinLab Vietnam: Digital Gateway to Global Markets empowered SMEs with insights and connections to scale globally with confidence.

Just like that, 2023 has come to an end. UOB FinLab has achieved a fulfilling year with countless achievements, continuous improvements and lots of laughs. This could not have been done without the relentless support from the team at UOB FinLab. Everyone, regardless of seniority, went above and beyond to support SMEs across ASEAN achieve their digitalisation and sustainability goals.

We would also like to thank all the SMEs that participated in our programmes. We are constantly learning from SMEs to better understand the challenges they face, and ensuring that our programmes are tailored accordingly. UOB FinLab trusts that all SMEs benefited from our programmes, be it through our insights, networking sessions or access to our vast ecosystem of resources, industry experts and online tools.

Lastly, we would like to give a big shoutout to everyone in the UOB FinLab ecosystem including the various business and technology experts, industry leaders and mentors. This is truly a collaborative effort and our success is testament to the strong ecosystem we have built together.

As we head into 2024, let’s take a moment to reflect on our top milestones in 2023 and what 2024 has in store for us.

We expanded our presence in two additional markets, officially launching UOB FinLab Vietnam in June 2023 and UOB FinLab Indonesia in September 2023.

In Vietnam, we will grow our network through collaborations with local university professors, industry practitioners and innovation experts. Our approach for Indonesia is the same and we have signed various MOUs with leading local players to help businesses grow digitally and sustainability. Some Indonesian partners we will work closely with include; the Employers’ Association of Indonesia (APINDO), the Indonesian Young Entrepreneurs Association (HIPMI JAYA) and SMESCO, the Indonesian Public Service Agency for Small to Medium Enterprises and Cooperatives.

This is a huge milestone for us as we are now present in five key markets across ASEAN. Our presence in Singapore, Malaysia, Thailand, Vietnam and Indonesia will further enable SMEs to tap onto our cross-border network to drive digitalisation and sustainability initiatives.

We believe that SMEs across all industries in ASEAN are, and will continue to be a major driver of the region’s economic growth. While there have been many initiatives to support SMEs by public and private firms, this growing sector still hosts many industries that are overlooked and underserved. Two examples of this are the arts industry and the mother entrepreneur (mumpreneur) sector.

Although these sectors are smaller in nature, UOB FinLab believes that these two groups play a huge role in society. The arts preserve and express a country’s cultural identity, history and heritage, which creates a sense of belonging among people. Mumpreneurs are a growing economic driver that has changed the business world by bringing more women into entrepreneurship. This introduces a unique perspective to the business world – showcasing the immense opportunity to build an online business while focusing on the need for flexible working hours, family-friendly policies, and socially responsible practices.

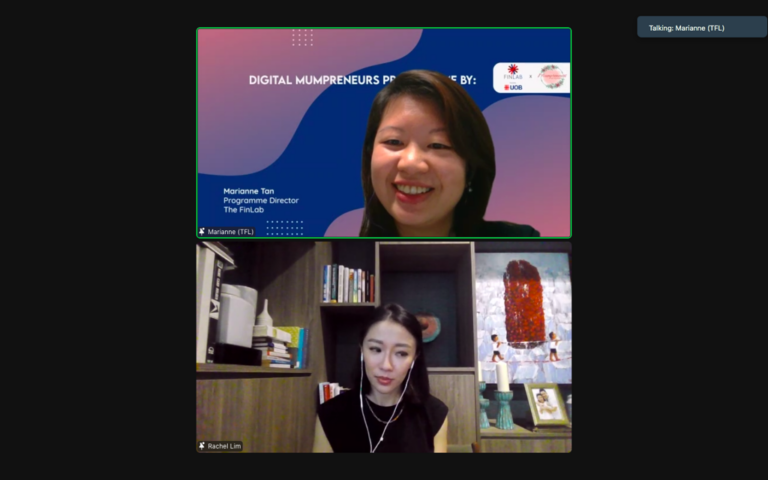

SMEs within these industries have unique challenges when implementing digitalisation strategies to propel their business forward. This is why we developed tailored programmes such as our Acceleration Programme for the Arts and Digital Mumpreneurs Programme. By having programmes customised to serve growing industries, we believe businesses will maximise their digital capabilities to scale and maximise growth opportunities.

The Acceleration Programme for the Arts is made for SMEs in the arts industry and includes workshops on marketing, customer retention, consumer credit card journeys and best practices for operating a commercial business. Following the same tailored approach, our Digital Mumpreneurs Programme equips mumpreneurs with the best practices on business setup, online marketing, e-commerce, back-end operations and maximising sales.

Beyond this, we want to support SMEs across industries to unlock their potential via artificial intelligence. Technology is ever evolving, and it is crucial for SMEs to understand how new technological solutions can support their businesses. We saw how rapidly artificial intelligence (AI) was adopted across industries in 2023. AI was incorporated to streamline operations, increase productivity, reduce costs and increase overall profitability and business sustainability. We recognised the potential of AI and that the benefits afforded through its adoption will continue into 2024 and years to come. The UOB Finlab ecosystem continues to support SMEs to leverage AI to support them in various workflows like customer service, repetitive and administrative tasks as well as bookkeeping and revenue organisation. It is crucial for SMEs to leverage on such technology to further optimise their own workforce productivity.

It is important that we recognise our achievements in 2023 and acknowledge everyone who made it such a success. As we head into the new year, we see three key trends that will take precedence in SMEs across ASEAN.

The first is the increasing demand for SMEs in ASEAN to expand overseas. This trend is aligned with a UOB report stating that four out of five businesses in ASEAN are prioritising overseas expansion in the next three years. Southeast Asia, especially Singapore, Malaysia and Thailand, will continue to be a hot destination for business expansion due to its proximity and promising business outlook.

We understand that with any business expansion, it is always challenging to find the right local partners – especially when expanding to a new market. This is why we focused on establishing a strong regional network across ASEAN in 2023. This will enable SMEs across borders to tap into our ecosystem to better understand the best local practices, expansion strategies and find suitable local partners to grow their business.

The second trend we foresee is the increasing need for businesses in ASEAN to adopt ESG practices. Incorporating sustainability enables companies to preserve the planet for future generations while attracting investors, improve their reputations and improve collaboration with larger corporations. Although only 45 per cent of businesses have implemented sustainability practices in their operations, we believe that this number will increase.

Various green finance initiatives, such as Financing Asia’s Transition Partnership (“FAST-P”), will help businesses in ASEAN implement green initiatives. However, greater education will be required by SMEs to ensure they have a long-term understanding of how to best implement such initiatives and adapt to the ever-evolving requirements. Workshops such as UOB FinLab’s Sustainability Innovation Programme, will be paramount to ensure businesses employ the best practices and strategies when transitioning to a green business.

The last trend we are witnessing is the growth of greentech solutions. As more companies go green, there will naturally be a demand for innovative greentech solutions to meet the economic and environmental needs of businesses. To achieve this, it is crucial for greentech solution providers to work closely with SMEs, corporates and industry leaders to pilot and commercially deploy solutions. UOB FinLab’s GreenTech Accelerator programme does that and enables access to world-class mentors and industry experts.

UOB FinLab is ecstatic to see what 2024 has to offer and we are looking forward to the continuous growth of our ecosystem. We remain committed and will continue to help SMEs in ASEAN unlock growth opportunities through our digitalisation and sustainability initiatives.

To learn more about UOB FinLab programmes, click here.

UOB FinLab Vietnam: Digital Gateway to Global Markets empowered SMEs with insights and connections to scale globally with confidence.

As Singapore advances its Green Plan 2030, UOB FinLab is working with SMEs to turn sustainability into a pathway for growth, resilience, and long-term success.

At UOB FinLab, we’ve spent the last 10 years enabling SMEs across the region to adapt, transform, and thrive, no matter how the market moves.

Designed for business owners to enhance their digital capabilities through practical learning, this programme takes businesses to the next level.

Designed for business owners to enhance their digital capabilities through practical learning, this programme takes businesses to the next level.

Bridge ideas and innovation, subscribe to the FinLab Connect now!