Sustainability Innovation Programme

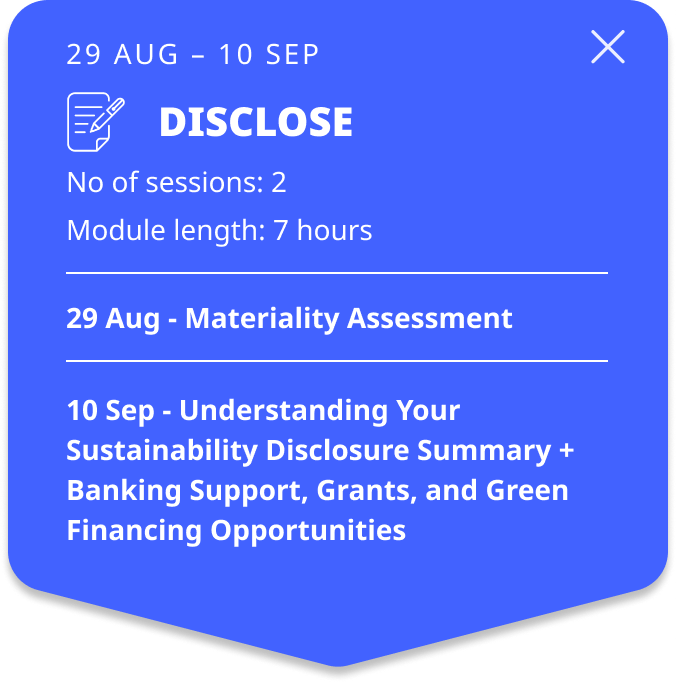

15 Aug 2024 – 26 Sep 2024

UOB FinLab’s Sustainability Innovation Programme

(SIP) is a 5-week programme to help SMEs transform their companies into sustainable and green businesses. Learn how sustainability can play a part in your business to balance impact while ensuring profit and productivity.

Registrations Now Open!