UOB X NAFA: Treasures of Angkor Virtual World was created as part of the Southeast Asian Arts Forum. This immersive experience blends culture and technology for people to dive deep into the history of a UNESCO World Heritage – Angkor Wat.

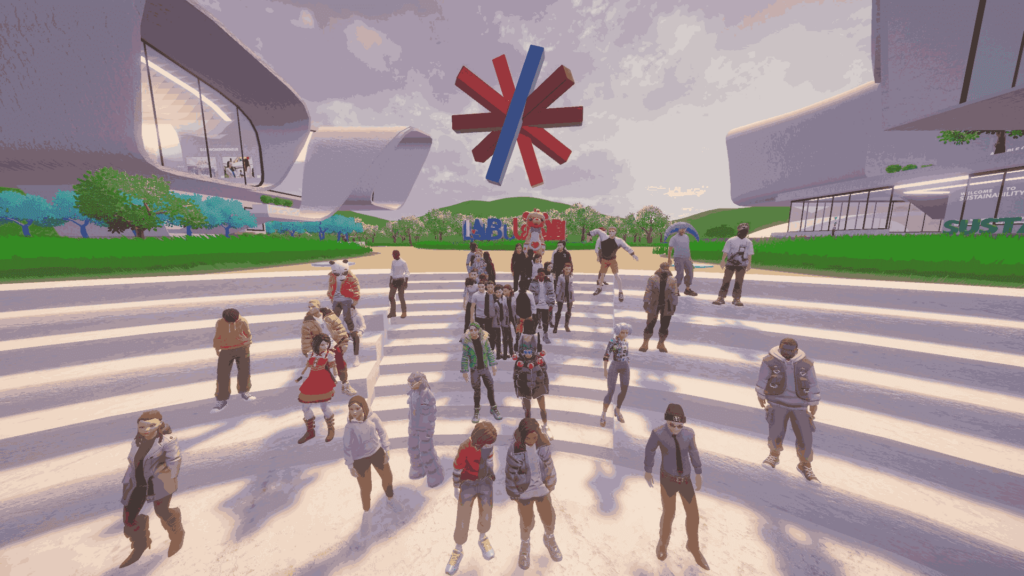

Programme participants are gathered at FinLab World’s Auditorium, awaiting the livestreaming of our virtual GreenTech Accelerator session

Our UOB FinLab colleagues with the UOB leaders who were mentors for the programme, and the participants.

Ms Ethel Tan, Co-Founder of Edith Patisserie (on the left) shared with Stella Chua (on the right), Head of Strategic Partnerships, Business Banking, and the participants about how she turned her passion for baking into a dessert brand, while remaining prudent in expanding the business at the inaugural womenpreneurs event on 25 March 2024.

Wrapping up D.I.P:W+ with the last masterclass on LinkedIn Strategy – Building your brand on LinkedIn organically.

This year, UOB FinLab kicked-off the SIP programme with a panel discussion on 15th August 2024 discussing sustainability implementation amongst Singaporean SMEs, including the current pace of adoption, hurdles, and solutions. From the left to right, Samuel Tan, Vice President, ESG Solutions, Sector Solutions Group, UOB; Lionel Wong, Deputy Director and Head, Green FinTech Office, Gprnt; Yina Chua, Associate Director, NUS Cities; Kang Jen Wee, Founder and CEO, Redex and Tham Kok Wing, Head of ESG Coordination Office, Singaproe Business Federation.

UOB FinLab kickedoff The GreenTech Accelerator Programme 2024 with a launch event in Singapore, Malaysia and Thailand, where the 33 greentech finalists are unveiled.

The GreenTech Accelerator Showcase Day that was held on 4th November 2024 as part of the Singapore FinTech Festival’s Insight Forum unveiled the 16 pilots and celebrated the GreenTech, mentors and challenge partners that have been with us on the 6 months journey.