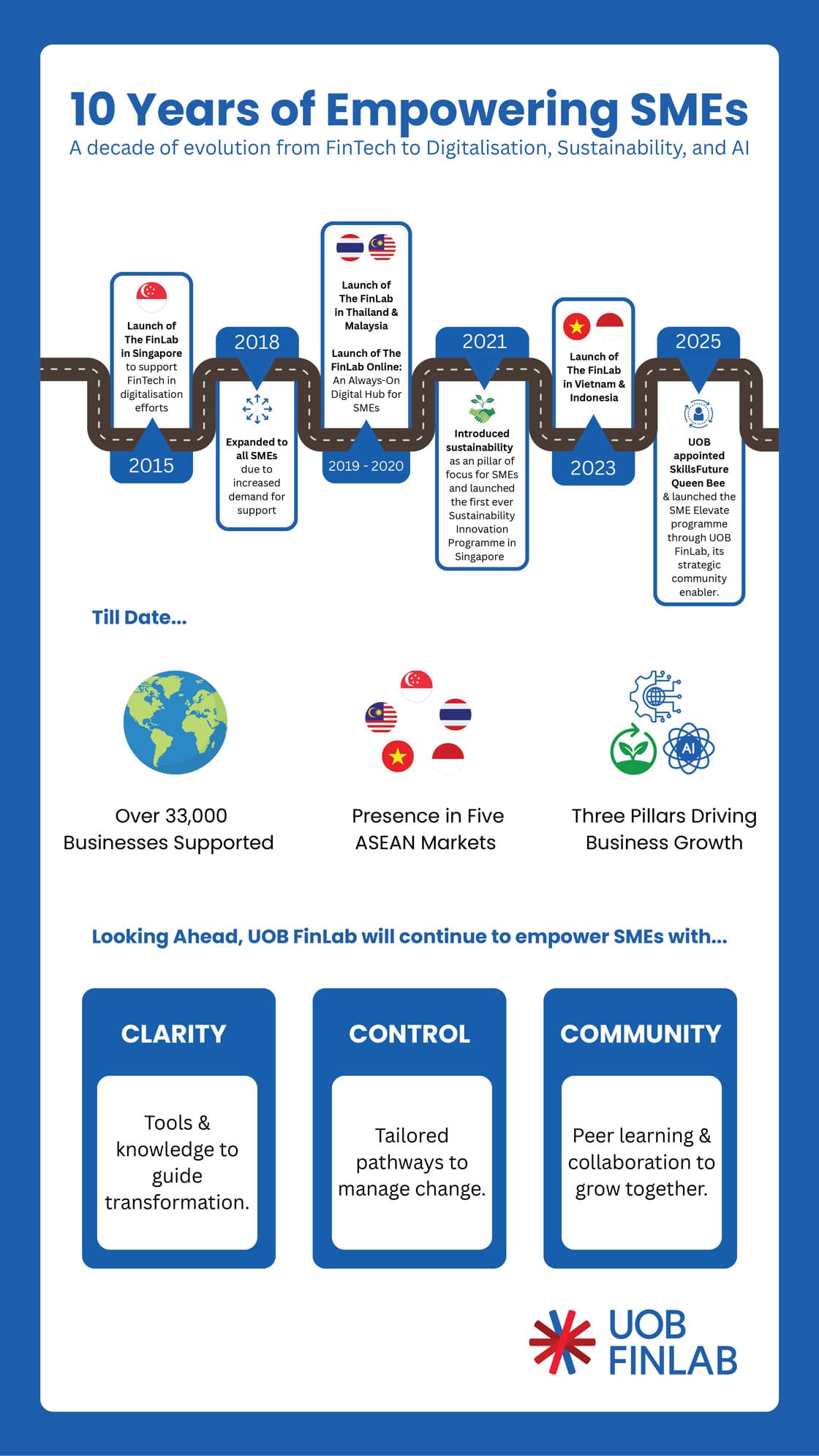

To date, UOB FinLab has supported more than 33,000 businesses globally, including SMEs, startups, greentechs, corporates, and ecosystem partners.

What began as a FinTech-focused incubator has expanded into a regional platform that empowers traditional businesses to digitalise, adopt sustainable practices, and seize new growth opportunities. Over the years, UOB FinLab has continuously evolved to meet the changing needs of businesses across ASEAN:

- FinTech Acceleration in 2015

- Digital Transformation for all SMEs in 2018

- Focus on Sustainability in 2021

Most recently, SkillsFuture Singapore (SSG) appointed UOB as its latest SkillsFuture Queen Bee (SFQB), and as part of this appointment, UOB is supporting SMEs through its strategic community enabler, UOB FinLab, with the launch of the SME Elevate Programme. This appointment reflects the bank’s deepening commitment not only to provide solutions, but to build a robust ecosystem of learning, collaboration, and transformation.

The SME Elevate Programme focuses on Artificial Intelligence (AI), digitalisation, and sustainability, recognising their critical role in driving productivity, innovation, and competitiveness for SMEs. Its first initiative, the AI Ready Programme, offers a practical, hands-on experience for business and technical leaders, equipping them with the knowledge and tools to explore, adopt, and scale AI solutions that deliver real business impact.

UOB FinLab’s strong foundation in community-building and mentorship is its key differentiator as a SkillsFuture Queen Bee. It connects businesses to tailored innovation pathways, hands-on guidance, and peer learning opportunities, which empowers SMEs to confidently navigate transformation challenges and unlock new growth.

These tools and programmes are continually evolving to meet the changing needs of SMEs, which reinforces UOB FinLab and UOB’s mission to provide the clarity, control, and community businesses need to scale sustainably in an increasingly complex marketplace.

For SMEs, this means staying competitive in a world where technology is advancing faster than ever.