Upskilling: A Key Strategy to Futureproof SMEs in a Digital and Sustainable Economy

Upskilling is the key for SMEs to thrive in a digital and sustainable economy—and UOB FinLab is here to make it happen.

As consumers, we are now used to having the world at our fingertips. This is the age of the Internet, allowing each of us instantaneous access to information, thus empowering us as consumers, but also driving the standards of customer service and delivery higher than before. Consumers today are brand promiscuous – we use technology to connect with multiple brands, before deciding what we want, when we want it.

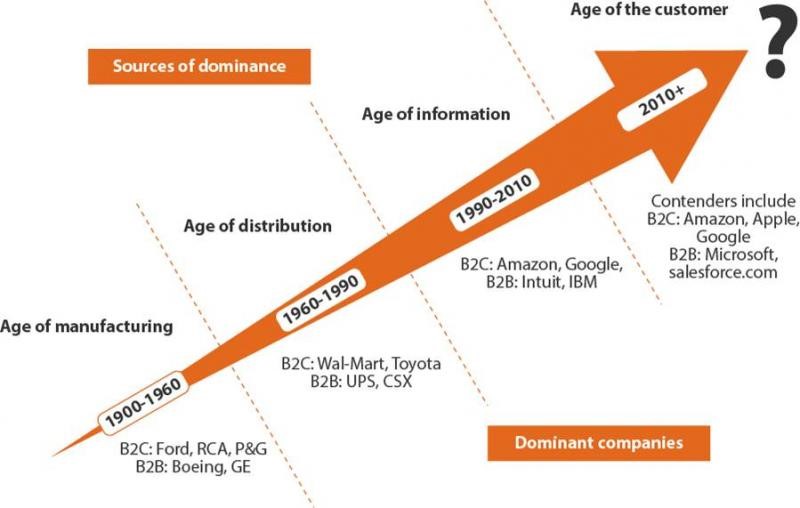

Forrester calls the era that we live in today the “Age of the Customer”, where businesses seeking to earn the consumer dollar are constantly reinventing themselves to systematically understand and serve increasingly powerful consumers.

Now, businesses that want to win not only has to fulfil consumers’ needs at that time of purchase, but also pre-empt those needs.

Until recently, there was less of a strategic imperative for businesses to be customer centric. In a red ocean environment with well-defined competitors and the absence of freely available information for consumers, businesses used to hold the balance of power. Now, the Internet has helped to eliminate this gap by creating a more transparent marketplace digitally. With the click of a button, consumers are now able to compare product prices online, thus putting power back into the hands of consumers. For instance, the rise of online marketplaces and e-commerce websites such as ASOS, Alibaba and Lazada in recent years has made pricing information readily accessible to consumers. This has thus heralded a new age of the customer.

In this new age, empowered customers are shaping business strategy. According to Forrester, customers now expect consistent and high-value in-person and digital experiences. By comparing service levels within industries, customers demand the highest standards and will go elsewhere if businesses cannot provide them.

The widespread availability of online reviews through forums and blogs are also sources of information that potential buyers will invariably access before the purchase of a product, especially if the product is an experience. Much of these online feedbacks are believed in strongly, especially if there are corroborative views. It is important, therefore, that businesses treat the customer journey as paramount to the success of their business, and treat all customers right.

Being customer centric is now a necessity for businesses today.

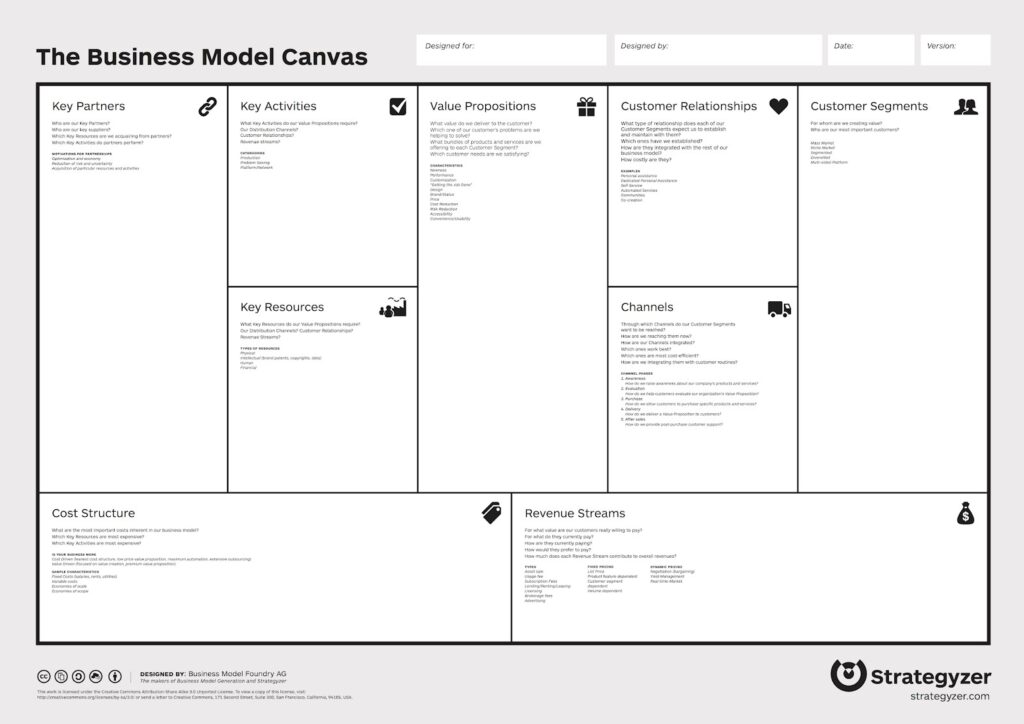

Businesses must therefore not be lulled into complacency by couching on a formula that used to work. To ensure a holistic shift toward customer centricity, a key criterion is a fundamental relook of the business model. In this way, any changes made to the business can be looked at and cascaded down in an integrated fashion. This article thus proposes that businesses adopt three simple yet effective frameworks to do so: Design Thinking (DT), Business Model Canvas (BMC), and Business Process Reengineering (BPR).

First, Design Thinking should be the foundational methodology underpinning every business. This framework is an iterative problem-solving process, and can be broken down into a six-step iterative process:

Six-steps process for design thinking

Design Thinking calls for the need to delve into the customers’ psyches and personas to best meet their needs. The importance of Step 2 – “Observe” – thus cannot be underestimated, for it is the foundation which the rest of the DT process relies upon. For instance, an environmental agency keen on improving recycling rates may realise that even non-recyclers do not actually mind recycling if inertia is reduced. With this in mind, the agency can roll out various pilots targeting this pain point specifically (perhaps more recycling bins, or an incentive-based system). Objective observation also allows for a glimpse of surprising and unexpected customer behaviour, which may help to strengthen the understanding of what the customer actually wants.

Even if the initial analysis and insight is wrong, rapid prototyping still provides a good platform for companies to try fast and fail fast. Successful or not, insights obtained can be subsequently incorporated into the company’s playbook, which ultimately provides a more well-rounded view of the customer.

The DT framework can then be applied onto a Business Model Canvas, a succinct summary of the business, which presents a structured way for managers to look at their business from a macro lens. By employing DT with BMC to understand customer needs and preferences, business leaders can then systematically map out and critically analyse how value is currently being delivered to customers. DT can be embedded within the BMC, in order to understand what customers really want.

In this way, a clear segmentation of the business into nine separate blocks will provide business leaders with a perspicuous understanding of how the company is functioning. The deliberate segmentation of each part of the BMC also has the effect of raising pertinent questions for the business. For instance, separating the value proposition from the customer segment can allow businesses to see if their offerings are delivering value to their customers. Segmenting the businesses key resources and activities from the value proposition will also invariably raise questions on whether the business is carrying out the most important tasks to deliver value. All of these questions can then be translated into focused strategies to make the business more customer centric.

Lastly, once the macro-level direction of the company has been reviewed, its micro-level processes should be scrutinised to ensure that the customer experience is positive and the customer journey is well-delivered. After all, it is the day-to-day operations and experiences that customers judge the business on. This final step can be done through Business Process Reengineering, a structured breakdown and analysis of a company’s core processes.

To do this, managers first need to involve their ground-level staff across different divisions/business units to draw up their respective workflow process charts. Business leaders will then analyse company-wide processes to see which segments can be automated or removed completely. This can result in attendant cost savings and a better customer experience. For instance, Singapore’s National Library Board (NLB) conducted BPR to realise that getting library go-ers to use library cards was ineffective for two reasons – first, resources were wasted in the production of these cards; second, library go-ers would often misplace their cards. Through BPR, NLB noticed the flaw in its system and transitioned away from that process. It has since adopted a seamless ez-link card system (since nearly everyone uses an ez-link card!) for the borrowing of print and non-print materials. Therefore, BPR can be a positive sum game through which businesses are able to streamline their processes and value-add to their customers.

At the end of the day, however, the age of the customer is one full of opportunity. Even as customers get more demanding, new market spaces are opening up for businesses to compete in.

In this new modus vivendi, there is new value created for both customers and businesses alike, as businesses too are now able to leverage on technology and data to cross-sell and upsell their products. Amazon, for instance, analyses customer data to provide relevant recommendations which could cause the consumer to buy more products on their website, or purchase higher-value goods.

Being customer centric is therefore no longer just central to a customer’s experience of a brand, but also a distinct area of competitive advantage. And the businesses that understand and act on that first will be the new kings of the market.

Upskilling is the key for SMEs to thrive in a digital and sustainable economy—and UOB FinLab is here to make it happen.

UOB FinLab Indonesia held a series of its UKM SUKSES programmes, benefitting various Indonesian founders. The programme covered various topics such as smart tax strategies, health talks, business solutions, and financial foundations for startups alongside speakers who are experts in their field.

Continuing from last year, #UOBxWomenpreneurs series returns in 2025, organised by Business Banking Singapore (BBS), UOB FinLab, and Group Wholesale and Markets Marketing (GWMM) to engage and empower women entrepreneurs in Singapore. The initiative creates a strong platform for women-led businesses to access practical resources, mentorship, and a supportive network as they grow and lead with confidence.

Designed for business owners to enhance their digital capabilities through practical learning, this programme takes businesses to the next level.

Designed for business owners to enhance their digital capabilities through practical learning, this programme takes businesses to the next level.

Bridge ideas and innovation, subscribe to the FinLab Connect now!