UOB FinLab Thailand is Awarded the Climate Action Award 2025

UOB FinLab in Thailand has been conferred the prestigous Climate Action Award 2025 for its efforts in combating climate change

Find out more about how we can help with your digitalisation journey in Thailand.

UOB FinLab in Thailand has been conferred the prestigous Climate Action Award 2025 for its efforts in combating climate change

Look at how Thailand supports Thai SMEs to expand internationally through the E-Commerce Accelerator Programme (EAP)

Join us as we walk through the memory lane of 5 weeks with UOB FinLab’s Sustainability Innovation Programme 2024

Uncover the challenges SMEs in Southeast Asia face as they navigate the adoption of AI.

UOB FinLab unveils the 33 greentech finalists for the GreenTech Accelerator 2024 programme.

UOB FinLab is leading the charge in Southeast Asia by enabling SMEs to embrace the circular economy, reducing waste and sparking innovation. Dive into how these efforts are shaping a sustainable future for businesses and the environment.

Discover how UOB FinLab is empowering women entrepreneurs and business leaders across ASEAN with tailored programmes that drive business growth and digital innovation. Learn more about these transformative initiatives and their impact on the economy.

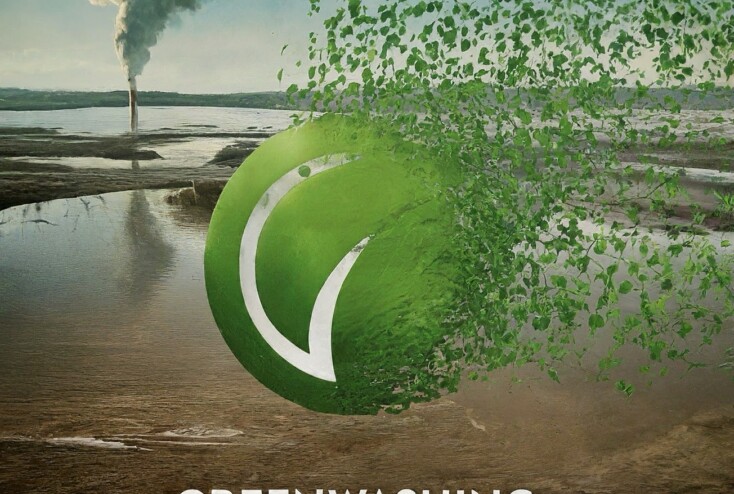

This is the second iteration of UOB FinLab’s Sustainability Series, in which we discuss greenwashing challenges in Southeast Asia and the adequate steps SMEs can take to tackle them.

With Asean contributing to roughly 25 per cent of waste worldwide, innovative tech solutions could help to manage waste and prevent refuse from contaminating the environment. While more climate tech start-ups are eager to drive change, many still lack support, exposure, and a platform to grow.

We now approach the final weeks before applications for UOB FinLab’s GreenTech Accelerator 2024 come to a close. We have received outstanding applications from hundreds of innovative greentechs that have the potential to make impactful contributions to the world’s sustainability goals of net zero.

UOB FinLab’s GreenTech Accelerator (GTA) strives to develop and market green technology solutions for business sustainability.

UOB FinLab’s GreenTech Accelerator (GTA) มุ่งมุ่งเน้นการพัฒนาและผลักดันโซลูชันเทคโนโลยีสีเขียว (green technology solutions) เพื่อความยั่งยืนของภาคธุรกิจ โดยจัดการอบรม, ให้รับคำปรึกษาจากผู้เชี่ยวชาญ, เน็ตเวิร์คกับเครือข่ายอันกว้างขวางของ UOB FinLab และได้รับเงินทุนสนับสนุนสูงสุดรวม 100,000 ดอลลาร์สิงคโปร์

Learn more about UOB FinLab’s key milestones in 2023 and how the team is staying committed to helping SMEs in the region.

Outdated internal management systems, operational efficiencies, rising costs — several factors could serve as barriers to growth for small-and-medium enterprises (SMEs), impeding their development and expansion process.

Southeast Asia is on the cusp of entering a golden age for economic growth and technological innovation thanks to rising mobile internet penetration rates, adoption of digital lifestyles and the number of start-up investments in the region.

Warrix Sport’s CEO shares his experience on how he brought his brick-and-mortar store online and what tools he used to do so

Consistent economic growth, a large and young population, proactive national initiatives and growing internet and smartphone penetration – these are key ingredients for the nation’s FinTech growth.

Thai SME Vachamon is one of the biggest importers and distributors of premium-grade fruits in Thailand, but they had bigger ambitions still. The FinLab helped them take things to the next level.

To accommodate the shift in consumer behaviour online, Double Goose expanded its operations in recent years to include an e-commerce platform.

Designed for business owners to enhance their digital capabilities through practical learning, this programme takes businesses to the next level.

Designed for business owners to enhance their digital capabilities through practical learning, this programme takes businesses to the next level.

Bridge ideas and innovation, subscribe to the FinLab Connect now!