What SMEs can do for Earth Day 2024

Discover how UOB FinLab is championing sustainable innovations with SMEs to drive positive change with transformative programmes. Join us in making a difference this Earth Day.

It is not the sole responsibility of individual stakeholders to overcome climate change challenges, drive decarbonisation efforts and achieve the ultimate goal of net zero – it is the collective effort across all industries and nations.

Mr Ravi Menon, Managing Director, Monetary Authority of Singapore mentioned during a speech at the Climate Leaders’ Assembly on 30 November 2023 at COP28 that: “To achieve a credible yet just transition, we need partnerships across domains.” This includes collaborations with stakeholders across governments, banks, scientists, industry players and the general public.

International collaborations are also key to achieve global climate goals. Every nation needs to work together to drive innovation, best practices and cross-border partnerships. Singapore is a good example of why cross-border collaboration is beneficial for all parties. The city-state has little access to renewable energy and relies on international cooperation in areas like the import of low-carbon energy through regional power grids. In turn, Singapore has been driving decarbonisation partnerships through various initiatives such as the Green and Shipping Corridors that provides players across ASEAN with a blueprint to transit to zero-carbon fuels.

UOB FinLab understands the importance of collaboration across industries and borders. This is why we established a vast ecosystem of government agencies, SMEs and key industry stakeholders across five markets in ASEAN – enabling our programme participants to gain access to knowledge, best practices, resources and new business prospects within our network.

REDEX, a participant from UOB FinLab’s GreenTech Accelerator programme, tapped into our ecosystem to meet industry leaders, bounce ideas off other players in the space and secure new clients. “Being in front of such a curated network opened REDEX up to many business touchpoints where we could collaborate and work with new partners. At the same time, we were able to contribute back to the space by sharing our key learnings with other industry players and our approach to long term sustainability,” said Alex Loh, Business Development Director, REDEX.

Green financing consists of a lot more than just buying solar panels and wind farms. To reach net zero by 2050, transition finance is required to support economy-wide transition strategies – providing funding support for businesses and sectors to adopt cleaner technologies, increase energy efficiency, and become greener over time.

It will include public-private partnerships such as blended finance which brings together stakeholders to contribute in complementary ways to make difficult transition projects like coal phase-out successful. To drive the greening of ASEAN, the Monetary Authority of Singapore (MAS) established Financing Asia’s Transition Partnership (“FAST-P”), a Singapore blended finance initiative in collaboration with key public, private and philanthropic sector partners that aims to mobilise up to US$5 billion to finance green transition and bankable green projects in Asia.

While green financing is needed to kickstart green initiatives and adoption, education needs to go in parallel to ensure companies, especially SMEs, have a long-term understanding of how to best implement such initiatives and adapt to the ever-evolving requirements.

“Even after receiving financing, companies do not fully understand how to adopt sustainability practices and are unsure what frameworks to use,” said Chris Ang, Director of Sin Gee Huat Recycling, another participant in UOB FinLab’s GreenTech Accelerator programme. “The entire industry, public and private, plays a huge role in propelling the mass adoption of sustainability practices through education. We need to collaboratively come together and support each other through knowledge sharing, resources and even workshops such as the Sustainability Innovation Programme or the GreenTech Accelerator programme organised by UOB FinLab,” he added.

The last highlight is the launch of the Singapore-Asia Taxonomy at COP28. For those who are not familiar with taxonomy, it provides financial institutions with guidance on how to identify and classify activities that can be considered green or transitioning towards green.

The Singapore-Asia Taxonomy is a massive industry milestone for many reasons. It’s the world’s first taxonomy that sets out definitions for transition activities. Right now, most taxonomies define what is green and what is brown, leaving out the bulk of economic activities that are in-between.

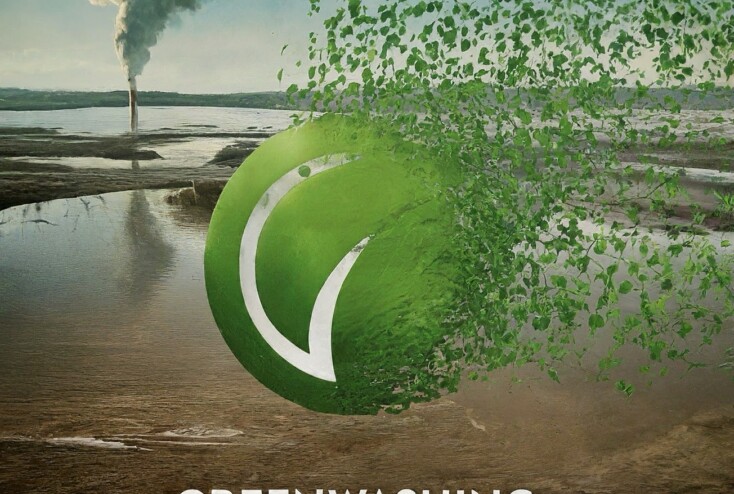

Transitioning into a green business takes time and it is important to ensure this transition is clearly defined to minimise greenwashing and false claims. As such, this taxonomy will provide institutions with guidance on how to identify and classify activities that can be considered green or transitioning towards green.

By having clear definitions, we believe that ASEAN will be at the forefront of sustainability adoption as companies will have access to financing when transitioning – encouraging businesses of all sizes to begin their journey towards a climate-friendly business that collectively meets net zero goals.

UOB FinLab will continue to support SMEs across all industries looking to kick start or further implement sustainability initiatives through our ecosystem, resources, and programmes. We will implement our learnings from COP28 to ensure that SMEs in ASEAN are equipped with the latest knowledge, industry best practices and resources needed to operate a sustainable business that will stand the test of time.

UOB FinLab offers two sustainability programmes:

To learn more about UOB FinLab, click here.

Learn more about COP28: https://www.cop-pavilion.gov.sg/

Discover how UOB FinLab is championing sustainable innovations with SMEs to drive positive change with transformative programmes. Join us in making a difference this Earth Day.

This is the second iteration of UOB FinLab’s Sustainability Series, in which we discuss greenwashing challenges in Southeast Asia and the adequate steps SMEs can take to tackle them.

With Asean contributing to roughly 25 per cent of waste worldwide, innovative tech solutions could help to manage waste and prevent refuse from contaminating the environment. While more climate tech start-ups are eager to drive change, many still lack support, exposure, and a platform to grow.

Subscribe to our Weekly Happenings by The FinLab Team!